Wilson Sonsini annually publishes the Silicon Valley 150 Corporate Governance Report, which analyzes the governance practices and disclosures of the Valley’s largest public companies. The report uses the Lonergan SV150,1 which includes the top 150 public companies (by annual sales) with headquarters in Silicon Valley. We will be publishing our full 2025 report in December, but we wanted to share some early data points.

Defensive Measures

When going public, most companies adopt defensive measures in their certificate of incorporation and bylaws to help prevent hostile takeovers. These measures can provide the board of directors with additional time and improved leverage to address unsolicited bids and negotiate more favorable terms with a potential acquirer. Following their initial public offerings (IPOs), companies come under pressure from institutional investors and proxy advisory firms (including ISS and Glass Lewis), as well as through the shareholder proposal process, to undo some of these measures. Accordingly, companies that are farther in time from their IPOs tend to have fewer defensive measures. This post discusses the prevalence of two common defensive measures—supermajority voting requirements for stockholders to amend the certificate of incorporation or bylaws and classified boards—among the Silicon Valley 150 (SV150) companies.

Supermajority Voting Requirements

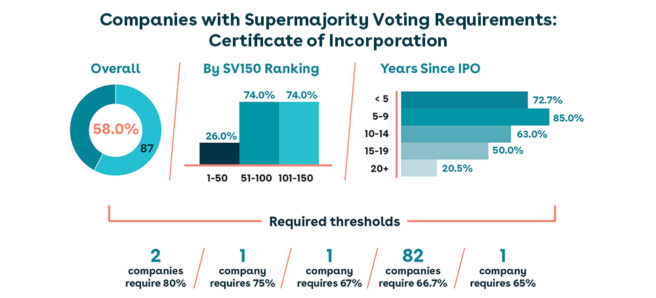

Amending the Certificate of Incorporation

Overall, 87 of the SV150 companies, or 58.0 percent, require a supermajority vote to amend the certificate of incorporation, a decline from 63.3 percent in 2024. Most of the SV150 companies with this provision (94.3 percent) set the supermajority approval level at 66.7 percent, with the remaining companies ranging from 65 to 80 percent. Continuing the trend shown in prior years, the largest companies in the SV150 (ranked 1-50 in terms of annual sales) are significantly less likely to have supermajority voting requirements than the companies ranked 51-100 and the companies ranked 101-150. Only 13 of the companies ranked 1-50, or 26.0 percent, have supermajority voting requirements to amend the certificate of incorporation compared to 37 of the companies ranked 51-100 and 37 of the companies ranked 101-150, or 74.0 percent in each case. When viewed in terms of years since IPO, younger companies (with fewer years since their IPO) are more likely to have supermajority voting requirements than more established companies. Nearly three-quarters of the SV150 companies that have gone public in the last five years have supermajority voting requirements to amend the certificate of incorporation compared to 20.5 percent for companies that have been public for more than 20 years.

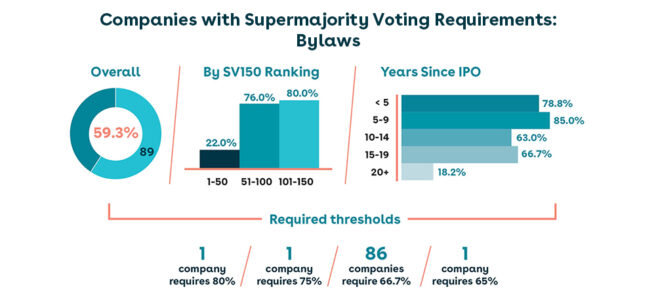

Amending the Bylaws

Overall, 89 of the SV150 companies, or 59.3 percent, require a supermajority vote to amend the bylaws, a decline from 63.3 percent in 2024. Most of the SV150 companies with this provision (96.6 percent) set the supermajority approval level at 66.7 percent, with the remaining companies ranging from 65 to 80 percent.

The inclusion of supermajority voting requirements to amend the bylaws follow similar trends as supermajority voting requirements to amend the certificate of incorporation. Only 11 of the companies ranked 1-50, or 22.0 percent, have supermajority voting requirements to amend the bylaws in contrast to 38 of the companies ranked 51-100, or 76.0 percent, and 40 of the companies ranked 101-150, or 80.0 percent. More than three-quarters of companies that have gone public in the last five years have supermajority voting requirements to amend the bylaws, which declines considerably to 18.2 percent for companies that have been public for more than 20 years.

Classified Boards

Companies with classified boards, also referred to as staggered boards, stagger director elections over a three-year period, with approximately one-third of the directors subject to re-election each year and any given director subject to re-election every three years.

Overall, 77 of the SV150 companies, or 51.3 percent, have classified boards. Following the trend in supermajority voting requirements, the largest companies (ranked 1-50 in terms of annual sales) are the least likely to have classified boards, at 24.0 percent. This jumps to 60.0 percent for the companies ranked 51-100 and 70.0 percent for the companies ranked 101-150.

When viewed in terms of years since IPO, the difference is considerable at the opposite ends of the spectrum: Two-thirds of companies that have been public less than five years have classified boards compared to only 6.8 percent of companies that have been public for 20 or more years.

1 For more information on the methodology used to prepare the Lonergan SV150, please visit https://lonerganpartners.com/2025-lonergan-silicon-valley-150-list/lsv-150-company-insights-2025.